In This Issue

Articles, Research & Spotlights

- Pension Reform Not Getting in the Way of Recruiting Public Workers

- Alaska Lawmakers Weigh Retirement System Options

- Proposal in Michigan to Divert Funding from Underfunded Teacher Plan

- Mississippi Has a Chance to Emulate Successful Reforms

- Proposal in Georgia to Keep Politics Out of Pensions

- Oklahoma Shouldn’t Undo Progress Made in Reforming Public Pensions

News in Brief

Quotable Quotes

Data Highlight

Contact the Pension Reform Help Desk

Articles, Research & Spotlights

Public Pension Reforms Aren’t Impacting Public Employee Turnover Rates

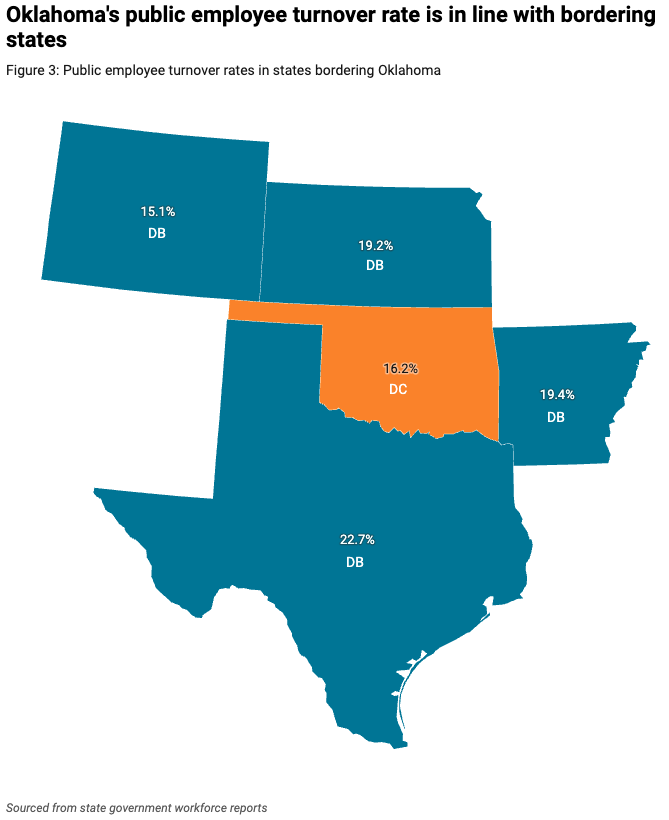

Critics of public pension reform often imply that adjustments to benefits or switching to a different type of retirement plan for new hires would hurt an employer’s ability to attract and keep teachers, police, and other government workers. However, an examination of employee behavior in states that have adopted these types of public pension reforms suggests otherwise. In this analysis, Reason Foundation’s Mariana Trujillo examines examples from Oklahoma and West Virginia, where government employers have experienced no discernable impact on recruitment and retention after adopting significant changes to state retirement plans in the past two decades. Despite switching to a defined contribution plan for new hires in 2015, for example, Oklahoma maintains a public employee turnover rate that is lower than its surrounding states who continue to offer defined benefits. West Virginia switched to a defined contribution plan in 1994 and then back to a pension in 2006, but neither of these changes had a measurable effect on the quality of teachers in the system. These results and others suggest that retirement plan design has little to no impact on the recruitment and retention of public workers.

Alaska Lawmakers Should Consider Costs and the Needs of Workers Before Rolling Back Pension Reform

Facing significant runaway costs associated with the state’s public pension systems, Alaska policymakers in 2006 elected to offer a modernized defined contribution (DC) benefit to new hires that posed no risk of unexpected costs or underfunding. However, state lawmakers are considering a proposal, Senate Bill 88, that would reverse that decision by bringing all existing and new hires back into the still underfunded pension systems. New actuarial analysis by Reason Foundation shows that undoing Alaska’s prudent reforms could realistically create a $9.6 billion burden on state budgets. In addition to these potential costs, policymakers need to consider the value of the proposed pension to employees. According to Reason’s analysis, the pension proposal would generate less value in retirement than the current DC plan for most of the state’s public workers.

One-Pager: Analysis of Senate Bill 88

Data Tool: Comparing the Value of DB vs DC to Public Workers in Alaska

Analysis: Alaska’s Supplemental Savings Program Outperforms Social Security

Redirecting Pension Debt Payment Could Cost Michigan Taxpayers $1.4 Billion

Michigan Gov. Gretchen Whitmer is proposing an annual $670 million debt payment be diverted from its initial purpose—paying down the more than $35 billion shortfall in funds needed to fulfill pension promises already made to teachers—to instead fund political programs. The justification for redirecting these crucial funds, according to the governor’s office, is that debt payments are no longer needed for the now fully-funded health plan for teachers. However, the policy would still be taking away valuable funds plan actuaries rely on to help in paying down expensive pension debt. Reason’s analysis of the proposal finds it could cost the state over $1.4 billion over the next 14 years.

Mississippi Lawmakers Can Take the Best from Other Successful Pension Reforms

With $25.5 billion in unfunded pension obligations and only 56% of the assets needed to pay for retirement promises already made to the state’s public workers, there is an urgent need for Mississippi policymakers to enact meaningful reform of the Public Employee Retirement System. As lawmakers identify the reforms that could help get the state on the road to a healthy public retirement plan, they should first study the changes that have worked in other states. Reason’s Steven Gassenberger summarizes successful public pension reforms from Texas, North Dakota, Arizona, and Michigan that could serve as valuable templates for Mississippi.

Preventing the Politicization of Georgia’s Public Pension Investments

Around the country, public pension funds are under tremendous pressure from politicians and interest groups to adjust their investment decisions to achieve goals beyond their core purpose of providing an affordable and secure retirement benefit. To protect public funds from this type of politicization, the Pension Integrity Project encourages legislation that establishes strong boundaries focused on fiduciary agreements with pension members and taxpayers. Georgia House Bill 481, which seeks to protect public money from political influences, recently received bipartisan support in both the House and Senate and now awaits Gov. Brian Kemp’s signature. As Reason’s David Morgan testified to the Georgia House of Retirement Committee, this legislation would strengthen the emphasis on fiduciary duty for administrators of public pension funds and trusts.

Bill Threatens Oklahoma’s Pension Progress

Oklahoma House Bill 2854 would abandon the state’s defined contribution plan and reopen the state’s previously shuttered pension plan for new and existing public workers. In response to growing pension costs and unfunded liabilities, lawmakers voted to make the DC plan (named Pathfinder) the main retirement benefit for new hires beginning in 2015. Since then, Oklahoma has made significant progress in eliminating the debt associated with the legacy pension plan. As the Pension Integrity Project explains, bringing back the pension would gut one of the nation’s premier DC plans and expose state budgets and taxpayers to the same risks and runaway costs that brought about the needed reforms a decade ago.

News in Brief

Pandemic Fiscal Aid Increased Government Spending, But Some Money Flew to Pensions

An American Enterprise Institute (AEI) working paper by Jeffrey Clemens, Oliver Giesecke, Joshua Rauh, and Stan Veuger investigates the allocation of federal pandemic-era fiscal aid by state governments and its subsequent expenditure patterns, with a particular focus on pension funding. The study, analyzing data from the years 2020-2022, reveals that incremental pandemic-era fiscal aid to states primarily resulted in increased spending on general administrative services, with some increased spending on public employee pension benefits–despite explicit legislative restrictions on applying these funds toward pension contributions. The analysis indicates that for every $1,000 of additional federal aid per capita, states and local governments saw a $770 increase in total expenditures, with $379 directed toward general government expenditures and $72 toward pension funding. Notably, states with higher representation of public employees on pension fund boards allocated a larger proportion of aid toward pension contributions. The full working paper can be found here.

Quotable Quotes

“A lot of the comparison have to do with people wanting us to take more risk…Well, they weren’t saying that during COVID when our plan lost half as much as other plans did…What they want to do is find a benchmark in time that fits their narrative…We don’t pay our retirees with benchmarks; we pay them with cash.”

— North Carolina State Treasurer Dale Folwell, quoted in “Folwell says critics underestimate pension, health plan challenges,” Business North Carolina, March 6, 2024.

Data Highlight

Each month, we feature a pension-related chart or infographic of interest generated by our team of analysts. This month, we are showcasing a graph from Reason’s Mariana F. Trujillo, visualizing the public employee turnover rate in Oklahoma and its bordering states. Oklahoma is the only state pictured here with a defined contribution plan for new public employees, yet its turnover rate is among the lowest. Access the visualization and a detailed examination of the topic here.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.